Auto Packaging Features

Institutions can create financial aid awards for their students by either manually adding awards or by using the Auto-Packaging and Batch feature in Anthology Student. This method requires some manual steps by an authorized user.

The Auto Packaging feature ensures that the Auto Eligibility logic provides regulatory compliance within the automated processes and that all necessary rules are being enforced during the Automated Eligibility evaluation. The logic will calculate and validate award amounts for all Pell formulas, and ensure that aid received by students from prior institutions is also considered when Title IV aid awarded by an institution is being evaluated for disbursement approval. It will implement all the required formulas and regulatory validation within the processing logic.

Any fund source with an Awarding Fund Source Priority of 0 will not be increased, decreased, or canceled when Auto Packaging is run. Those funds with a priority order of 1 or higher are awarded up to the total need-based/non-need-based limits. If the student's need-based aid has been fully awarded, any additional need-based funding is not awarded. Institutional Charges and/or Cost of Attendance are awarded up to the total aid limit although any additional funding is not awarded if the student's total Institutional Costs and/or Cost of Attendance have already been fully awarded.

Rules

Some of the rules enforced are described below:

Auto Awarding will only package the funds and budget for a student in an Active status category. When the Status Represents a Title IV Withdrawal![]() field is enabled for a current Active status category (see Add or Edit Student Statuses), Auto Awarding will not auto-package the funds and budget for a student in "Active but Withdrawn" status.

field is enabled for a current Active status category (see Add or Edit Student Statuses), Auto Awarding will not auto-package the funds and budget for a student in "Active but Withdrawn" status.

If a student has multiple enrollments for the same or a different program and/or program version, the system will only review the current enrollment status program to determine what Cost of Attendance and Fund Source Rules will be used to confirm the student's eligibility, and only that current enrollment status program will be awarded against. Any student with a connected enrollment will be awarded against the default enrollment. All disbursements within a fund will be awarded in a single enrollment status as configured and not against the student's enrollment status of each payment period within that academic year.

Payment periods are essential when determining student financial aid award amounts. All Title IV awards are made on a payment period basis, except for Federal Work-Study (FWS) payments. Therefore, determining payment periods is the first step in determining award and disbursement amounts.

If the Pell grant has eligible funding that can be awarded between two award years because the payment period starts in one award year and ends at least 1 day into the next award year, the system will award from the prior award year based on the student’s remaining eligibility. If all funds have been awarded from the prior award year, the system will award the future award year based on the student’s remaining eligibility. To award the Pell grant between 2 award years for the same payment period, the fund must be configured as follows: Configuration > Financial Aid > Fund Source > Pell Grant and the “Package Crossover Term/Payment Period with Award Year 2 ISIR” check box must be selected (enabled).

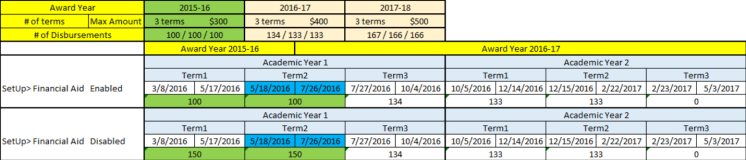

Users can configure Auto Awarding (Package & Repackage) to specify whether Pell funds are awarded during a crossover payment period for all Academic Calendars.

-

By default, Auto Awarding awards Award Year 2 Pell funds during a crossover payment period only if the Award Year 1 Pell funds have been exhausted.

-

When you select “Crossover Payment Period by Award Year 2” on the Automated Awarding Fund Source Rules form, Pell funds are awarded through Award Year 2 regardless if Award Year 1 Pell funds have been exhausted.

-

If the student is not eligible for Pell funds in Award Year 2, Auto Packaging will not award Pell through Award Year 2 even if there are remaining Award Year 1 Pell funds. You can handle this scenario by selecting the "Crossover Payment Period by Most Beneficial Year-Round Pell" option.

If no award year is specified in Award Year 2, exception AWARDPOP0023 will be displayed.

Auto Packaging can award Direct Subsidized loans, Direct Unsubsidized, and Pell grants loans to eligible students in an academic year that is shorter than a full standard academic year program. The system prorate the award amount based on the lesser of the two; credits/clock hours or weeks enrolled for non-term programs. The system awards disbursements based on the currently configured Packaged To Status.

For term programs, the program version is reviewed to confirm if it has an academic year containing fewer terms than the standard academic year. If it does, the loans are prorated based on the following calculation: number of credits in the student’s academic year, divided by the number of credits in the program version’s standard academic year, with that amount multiplied by the annual limit of the award.

When the last year of a multi-academic year program for a standard term (Academic Calendar 1 SE9W, 2, 3, 4) is made up of fewer weeks than the program version’s standard total of academic year weeks, the Direct Subsidized and Direct Unsubsidized loans will be prorated based on the number of credits on the academic year form against the standard configured full-time academic year credits of the program version.

Auto Packaging does not prorate the last academic year for standard term programs if students were enrolled for the full number of weeks in the academic year but the credits are less than the full number of credits in an academic year.

Auto Packaging reduces the number of disbursements by the number of terms left to be completed in the last academic year and updates the Loan Period Start/End Dates based on the terms being awarded. Auto Packaging reviews the Direct Loan Terms on the Awards form and only awards disbursements against the enabled (selected) terms, e.g., if 2 of 3 terms are checked on the Awards form, then 2 disbursements are awarded. See View or Change Term Associations for Direct Loans.

Note: The student's awarding is not to exceed the maximum amount the student is eligible for based on the annual loan limits or aggregate loan limits, as well as the Pell Lifetime Eligibility limit.

When determining payment periods for clock hour and non-term programs, transfer credits are subtracted from the credits or hours needed to complete the student's program of study. Once the remaining credits to complete are determined, the normal rules for determining payment periods apply. Because transfer credits can affect the payment periods for which aid is based, the system logic considers the transfer credits, reduces the overall program, and then adjusts the payment periods accordingly.

Auto Packaging calculates the Direct Loan COA by taking the Pell COA amount for the student's academic year being awarded and prorates it based on the number of terms the loan period includes by the standard number of terms in an academic year as defined on the Program Version. Normal rounding rules apply for this amount: .50 cents and more > rounds up.

Auto Packaging calculates the Direct Loan COA by taking the Pell COA amount for the student's academic year being awarded and updates the DL COA with the full Pell COA amount when the Loan Period is for the full academic year and encompasses the full standard AY number of terms. If a loan period has more terms than the standard academic year number of terms (SAY with summer), the DL COA will be the full Pell COA amount, the system will never have the DL COA exceed the Pell COA.

The system updates the DL COA each time the loan is auto-packaged but NOT when the loan is Locked or the status is Accepted, Batch to Send, or Rejected.

If Pell was previously awarded to a student at a branch of the same institution that is currently packaging Pell, the new award simply subtracts the previous amount from the eligible amount. If, however, the student was awarded Pell at another institution, the new Pell award must be based on the percentage of remaining Pell eligibility.

Stafford loans awarded to undergraduate students at a prior institution may affect Stafford loans currently being packaged. For example, if a student was awarded a Stafford loan at a prior institution, and then the student withdraws from that institution and enrolls at a second institution before the Borrower Based Academic Year (BBAY) has expired (including the 30 weeks component of the academic year definition), the second school must consider the original loan amount when packaging a new Stafford loan. The second institution may award the difference between the original loan disbursed at the prior institution and the student's loan eligibility, or the second institution can wait until the original BBAY has expired and award a new loan for the full eligibility based on the student's current grade level.

The National Student Loan Data System (NSLDS) section of the ISIR contains the scheduled and disbursed amounts, as well as the Title IV loan period and amounts. This information can be used to determine the percentage of Pell for which a student is eligible when packaging aid. It can also be used to determine whether a student has completed the BBAY at a prior institution.

An NSLDS history form in Anthology Student has been configured to provide prior funds used at prior institutions. This form has a button to import NSLDS data from a specific award year ISIR, such as the Federal School Code of the prior institution, Scheduled Amount and Disbursed Amount for Pell, Academic Competitiveness Grant (ACG), National SMART Grant, Begin Date, End Date, Grade Level, and Disbursed Amount for Stafford Loans. These values will be populated on the form and you can edit the values if authorized.

Note: You can always manually enter the values on the form, even if you have never imported the information by using the button on the form.

The Auto Packaging logic can use the data contained in the form to determine the percentage of Pell, ACG, and SMART amounts disbursed at a prior institution, to limit these awards to only the remaining eligibility. The Automated Awarding logic will also use the fields to ensure that Title IV loans are limited to the annual and aggregate loan limits, need-based aid, and additional unsub. If the prior institution's loan period has not been completed while attending the current institution's loan period, an overlapping loan period is created and funds are prorated accordingly based on the academic calendar of the program and student's eligibility.

Auto Packaging can award students when they have overlapping loans by automatically creating the appropriate loan periods and loan payment periods when a Direct Loan (Subsidized or Unsubsidized) is awarded. The Direct Loan eligibility in the first loan period (overlapping loan period) is determined by subtracting the net amount received at the prior institution’s loan period from the maximum eligibility in the current institution's loan period. When auto packaging is performed, the latest NSLDS data is evaluated to ensure that Direct Subsidized Loans or Direct Unsubsidized Loans for the current award year are awarded based on the most currently available aggregate value limit and/or prior loan history.

Programs using Academic Calendars 2, 3, and 4 will mark the overlapping loan period as all the terms the prior institution's loan period touches so that 1 day of overlap can impact the student’s current eligible amount. If there is still another term within the academic year, an additional loan period will be created for that amount of time and the difference of what was awarded for the overlapping loan period is compared to the student’s aggregate and annual award limit. Since the Direct Plus Loan is not held to the same overlapping loan periods as the Subsidized or Unsubsidized loans, its loan period will match that of the academic year and eligibility is based on the Department of Education standards.

| Prior Institution's Loan Period | 5/15/13 to 12/11/13 | ||||||

| NSLDS Funds Disbursed | DLSU for $2,000 | DLUN for $900 | |||||

| Dependent Freshman | 8/26/13 to 12/20/13 | 1/6/14 to 5/09/14 | 5/20/14 to 8/01/14 | ||||

| Terms | Fall | Spring | Summer | ||||

| SAY or BBAY | 8/26/13 to 8/1/14 | ||||||

| Overlapping LP | 8/26/13 to 12/20/13 | ||||||

| DLSU to be awarded $1,500 | |||||||

| DLUN to be awarded $1,100 | |||||||

| 1/06/14 to 8/01/14 | Loan Period 2 | ||||||

| DLSU to be awarded $2,000 | |||||||

| DLUN to be awarded $900 | |||||||

| Direct Plus Loan's Loan Period | 8/26/13 to 8/1/14 | ||||||

Programs using Academic Calendars 1, 5, and 6 will mark the overlapping loan period as beginning at the start of the academic year and running to the date the prior institution's incomplete loan period was set to end. This will allow the remaining net amount of what is eligible (based on what was not already used by the student within that prior loan period) to be awarded. The subsequent loan period(s) will start the next day and end based on the program's academic year length. The last loan period may end within a shorter time frame and may need to be prorated based on length or credits.

| Prior Institution's Loan Period | LP 32 weeks: OLP 12 weeks | NSLDS Funds Disbursed | DLSU for $2,000 | DLUN for $900 | |||||||||

| Institution's Academic Year | PP is 13 wks 450 hrs | PP is 13 wks 450 hrs | PP is 13 wks 450 hrs | PP is 13 wks 450 hrs | PP is 13 wks 450 hrs | PP is 13 wks 450 hrs | |||||||

| Student's Academic Year | AY 1: 26 weeks & 900 hours | AY 2: 26 weeks & 900 hours | AY3: 5 wks | ||||||||||

| Overlapping Loan Period | LP2: PP1 | LP2: PP2 | LP3: PP1 | LP3: PP2 | |||||||||

| 16 weeks 500 hours | 13 weeks 450 hours | 13 weeks 450 hours | 8 wks 300 hrs | 7 wks 300 hrs | |||||||||

| Overlapping Loan Period to award DLSU for $1,500 & DLUN for $1,100 | |||||||||||||

Formula 1 can only be used to determine award amounts for students enrolled in a program that uses Standard Terms. To be considered a Standard Term: all terms within the program must be substantially equal in length; there can be no overlapping terms, and 12 credits are considered Full-Time. Anthology Student supports calculations based on this formula.

Formula 3 can be used to determine award amounts for students enrolled in a program that uses Standard or Non-Standard Terms. To be considered a Standard Term: all terms within the program must be substantially equal in length; there can be no overlapping terms, and 12 credits are considered Full-Time. For credit-based programs that have terms that do not meet this definition for a Standard Term, Formula 3 must be used to determine Pell, ACG, and National SMART Grant disbursement and award amounts.

For Non-Term and Clock Hour programs, Formula 4 must be used to determine Pell, ACG, and National SMART Grant award and disbursement amounts. Anthology Student supports calculations based on this formula.

If a program is shorter in length than an academic year, Title IV loans must be prorated based on the length of the program. This is true whether the program is shorter in weeks, credits, or hours.

The bank fees added when loans are awarded are not removed when the budget is calculated again after awarding. Auto Awarding always updates the bank fees to match the fees of the full loans awarded on the Awards form (unless the fee is locked to prevent it from being updated). This ensures that the current or updated COA aligns with the funding that was awarded based on the full COA and its need-based calculations.

Formulas

There are minor differences when using the different formulas to calculate Pell, ACG, and SMART.

-

The Pell Scheduled Award is based on the student's Expected Family Contribution (EFC), Cost of Attendance (COA), and enrollment status; all three criteria determine the appropriate Pell chart to use.

Note: For the award year 2024-25 and later, automated awarding considers the Student Aid Index (SAI) instead of the Expected Family Contribution (EFC) to calculate a student’s unmet needs when awarding fund sources. The system treats any negative SAI value as zero (0).

-

For the ACG Grant and the National SMART Grant, a student must be full-time to be eligible for the awards.

This changed effective July 1, 2009, wherein a provision in H.R. 5715, Ensuring Continued Access to Student Loans Act (ECASLA), now allows less than full-time students enrolled at least half-time to be eligible for the ACG Grant and the National SMART Grant.

-

For ACG, the Scheduled Award is based on a $750 maximum award for first-year students and $1,300 for second-year students; the National SMART Grant awards $4,000 for 3rd-year students and $4,000 for 4th-year students.

This also changed effective July 1, 2009, because of another provision in ECASLA to include a fifth year of eligibility for the National SMART Grant.

Calculating Eligibility Used and Total Eligibility Used

The COD System calculates Eligibility Used (EU) and Total Eligibility Used (TEU) for all existing and incoming National SMART Grant awards.

EU and TEU will be calculated slightly differently for the National SMART Grant than for Pell. The EU calculation will be driven by Grade Level and Award Year since students are allowed to have more than one National SMART Grant award at an Attended School within an Award Year. A student can also be in the same Grade Level for more than one Award Year, and the Scheduled Award Amounts are subject to change from one year to the next.

Title IV Eligibility Configurations

Eligible Health Professional

When students are eligible for additional Direct Unsubsidized Loan funds because they are in an eligible health profession program, the student's academic year form should have the Eligible Health Profession field updated to reflect the additional amount of $16,667 or $26,667 accordingly. The default setting is Not Eligible or Declined which will limit loan funds.

Additional Unsub for Dependent students when Parent Plus Loan is denied

A dependent student’s additional unsub beyond the $2000.00 is only awarded by Auto Awarding when the PLUS Credit Decision on the student’s academic year sequence form is notated with Credit Denied (code F), Credit Denied after Pending (Code N), and Credit Denied; Endorser Denial (code D). This field cannot be modified when a PLUS loan has been awarded - it must be deleted from the award form if present.

Both the Direct Subsidized and Direct Unsubsidized loans will be awarded accordingly per the student’s grade level and dependency status. If the student has funds that were used at a previous institution and the NSLDS Form for that award year is updated, the system will review if the student is in an overlapping loan period and/or if aggregate limits would reduce the amount of funds to be awarded at the current institution.

When the last year of a multi-academic year program for a standard term (academic calendar 1 SE9W, 2, 3, 4) has the last academic year for fewer weeks in the Academic Year than the program version's standard academic year weeks, the Direct Subsidized and Direct Unsubsidized Loans will be prorated based on the number of credits on the academic year form against the standard configured full-time academic year credits of the program version.

Both the Direct Subsidized and Direct Unsubsidized loans will have the same overlapping loan periods. Each loan will be awarded based on funds used at a previous institution and on remaining funds eligible for the current institution to complete the overlapping loan period. If the Direct Subsidized aggregate loan limit has been reached, the student will be awarded the full annual limit with the Direct Unsubsidized loan.

Non-term programs should not have a loan period already configured but if one is found and Automated Awarding can’t update all the loan periods accurately for the student’s full program, AWARDPOP0021 will be displayed to inform you that the loan periods will need to be deleted and the student should be awarded again. If any loan period has an originated loan or paid disbursement, AWARDPOP0022 will be displayed to inform you that you will need to manually review the student’s funds and make manual updates if origination changes are needed.

When a student is eligible for the Iraq and Afghanistan Service Grant (IASG), Auto Packaging will award the fund for a full-time enrollment even if the student is configured to be awarded for a lesser enrollment status. If only full-time enrollment status students should receive the fund, a fund source rule should be written accordingly.

The Pell grant is an entitlement that is not restricted by Cost of Attendance, Institutional Charges, or remaining need but is awarded based on the Pell Chart enrollment status configuration, COA/EFC. If you configure a Fund Source Rule Max Amount that is less than the student's eligible amount, the reduced amount will be awarded.

The Pell grant fund source will not be auto-awarded for students with Department of Education codes 6 or 7 (Graduate or Professional)

The Pell grant can be awarded at the program level or campus level based on the:

-

Cost of Attendance form configuration of “Select Enrollment Status Using: Prior Completed Term, Package To Status, or Default COA” at the program version level

-

Settings and Triggers form configuration of “Select Enrollment Status Using: Prior Completed Term, Package To Status, or Default COA” at the campus level

For the Award Year 2023/24 and earlier, the enrollment status the grant is configured to be awarded by is reviewed on the Pell chart, based on the COA and EFC, to determine the award amount. The Pell grant is always originated as a full-time amount, regardless of the award amount configured.

For the Award Year 2024/25 and later, the enrollment intensity the grant is configured to be awarded by is reviewed on the Pell chart, based on the SAI along with the Pell Max and Pell Min amounts, to determine the award amount. The Pell grant is always originated as a full-time amount, regardless of the award amount configured.

Auto Packaging will review the NSLDS form to determine if a previous institution has used funds for the current award year since this could reduce the percentage of remaining funds to be awarded. The student’s ISIR is also reviewed to determine if the Pell Lifetime Eligible Usage is close to or has reached the 600% limit, which could reduce the percentage of remaining funds to be awarded.

-

If the fund source is configured to award in whole dollar amounts and the last disbursement is reaching the 600% limit, Auto Packaging will round the final disbursement amount down so that the total award doesn’t exceed 600%.

-

If the Pell grant disbursements cross over between two academic years and the job is run to only award a single academic year when you run a new job to award the subsequent academic year, the remaining eligible funds will be awarded accordingly.

-

If the Pell grant for an award year has been exhausted and a single payment period crosses over the current and future award year, that payment period will be awarded with the future award year fund source if a valid ISIR is on file and the Pell Fund source has been configured to enable the “Package Crossover Term/Payment Period with Award Year 2 ISIR” option.

-

If the Pell grant was awarded in a prior academic year and the fund was locked, but the student was still eligible for additional funding in a subsequent academic year, AWARDPOP0017 is displayed to inform you to unlock the fund, or you can manually update the remaining eligible funds.

-

If the Pell grant was awarded in a prior enrollment, and you are trying to award the same Pell grant award year within the current enrollment, AWARDPOP0035 is displayed to inform you that the fund source could not be awarded.

-

The fund source will not be auto-awarded for students with Department of Education codes 6 or 7 (Graduate or Professional) since these codes prevent them from being eligible for awarding.

The last academic year of a non-term program could warrant a Pell proration if the academic year clock or credit hours are not a full standard academic year length per the program version set up. The last academic year of a term program is not prorated but each term remaining will be awarded the enrollment status for that COA/EFC accordingly.

Most Beneficial Year-Round Pell Grant for Crossover Payment Periods

The Auto Packaging Job creates exception AWARDPOP0026 when an Award Year 1 Pell grant is awarded and locked for a crossover payment period and then Award Year 2 Pell grant becomes the "Most Beneficial Year Round Pell Grant" award but cannot be awarded.

Automated Awarding Updates the Estimated Award Year COA Value

When calculating the budgets for award years 2024/25 and later, Automated Awarding updates the Estimated Award Year COA field value on the Pell fund source through the same stored procedure used when the Pell grant is manually awarded, and the actual COA budget is saved. If the current academic year has 23/24 and 24/25 award years, only the Pell grant for 24/25 will be impacted by the Estimated Award Year COA.

Automated Awarding increases or decreases the Pell Award Amount based on the full eligible amount compared to the Estimated Award Year COA as the Pell Amount can't exceed the Estimated Award Year COA value, except when the value is zero, the Max Pell Amount is awarded. If users wish to prevent awarding when the total budget is zero dollars, the Automated Awarding Fund Source Rule needs to add a new rule that requires the "Student Ac Yr Budget" to validate that the "Total COA" is greater than $0.00.

Automated Awarding will not update the Estimated Award Year COA if the field has been locked by a user.

For more details, see Background for Pell Grants on the "Background for Pell Grants" page.

Automated Awarding calculates the accurate Pell grant amount for each student in Test mode by using the test mode budget and its Estimated Award Year COA. The data on the student's budget or awards does not impact the calculation. When eligibility is reduced based on the Estimated Award Year COA, the test mode document reflects the students' true eligible amount of funds. Test Mode and Live Mode produce the same results as long as no changes are made to budget or eligibility.

Perkins Loans are awarded based on the Fund Source Rule Max Amount, regardless of the student’s prior loan history at the current or prior institution. Both the annual loan limit and aggregate loan limit are not evaluated when awarding this fund through Automated Packaging.

When the Pell Lifetime Flag is “E”, SEOG is not eligible for awarding because the student has reached the Lifetime Eligibility Used (LEU) of 600%. SEOG is only awarded when all payment periods within an academic year are within a single award year. If two award years fall within a single academic year, exception AWARDPOP0019 is displayed to inform you when to award each award year accordingly. When a student is in a study abroad program and the campus wants to award the full $4,400 of the SEOG, the additional $400 will need to be added manually as the max amount auto awarding will award is $4,000. SEOG Authorization can only be monitored by the Fund Source Activity Summary report.

The fund source will not be auto-awarded for students with Department of Education codes 6 or 7 (Graduate or Professional) since these codes prevent them from being eligible for awarding.

Auto Awarding will award 100% of the maximum amount, divided evenly by the program version's configured number of terms in a standard academic year for the quantity of term/payment periods of a specific award year. Therefore, a standard academic year of three terms would receive the maximum amount in the following payments: 33.34%, 33.33%, and 33.33%. You can configure uneven disbursement percentages by awarding using the Alternative Disbursement Schedule or the Award Year Definition.

When the SEOG Fund Sources’ Set Award Limits Maximum Amount is configured with an amount that is less than the Fund Source Rules Max Award Amount, the lesser amount is awarded by Auto Awarding. If the Fund Source Rules Max Award Amount is configured with an amount less than the SEOG Fund Sources’ Set Award Limits Maximum Amount, the lesser amount is awarded but will not exceed the Set Award Limit. If the SEOG Fund Sources’ Set Award Limits Maximum Amount is null, Auto Packaging always awards the Fund Source Rules Max Award Amount. The fund source will always be awarded with Award Year 1 unless all funds for that award year have been exhausted or if the crossover payment period between Award Year 1 and Award Year 2 has the Fund Source Rules “Crossover Payment Period by Award Year 2” check box selected.

When the SEOG Fund Sources’ Set Award Limits Maximum Amount has the “One Award Per Year” check box cleared, Auto Packaging awards the maximum amount without restriction per award year (multiple awards for a single award year) per academic year for any payment period or term within the award year beginning July 1 and running to June 30 respectively. When the SEOG Fund Sources’ Set Award Limits Maximum Amount has the “One Award Per Year” check box selected, Auto Packaging awards the maximum amount, restricted to one SEOG award per Award Year.

If Packaging (Settings > Financial Aid > Packaging) has the "Remove campus-based aid disbursements that cross over award years and adjust total amount" check box

-

Selected (enabled), the maximum amount will be prorated by the term start date that falls in the award year range for that award year.

-

Cleared (disabled), the maximum amount will be divided evenly by the term/payment period start date that falls in the award year range when awarding SEOG with a crossover payment period.

When the TEACH Grant is eligible to be awarded between two award years within a single academic year, exception AWARDPOP0016 is displayed so you can decide which award year should be awarded for the respective payment period(s).

Auto Packaging will award the TEACH Grant up to $4,000 per award year and always at a full-time enrollment amount. The fund will always be awarded with Award Year 1 unless all funds for that award year have been exhausted or if the crossover payment period between Award Year 1 and Award Year 2 has the Fund Source Rules “Crossover Payment Period by Award Year 2” check box selected.

The Fund Source Rules form has database fields under the NSLDS Data folder to configure rules to prevent and restrict the awarding of the TEACH Grant based on the student’s ISIR data.

A student's Work-Study (Title IV or non-Title IV) will be auto-packaged during initial awarding but also will retain the same fund source (if eligible) if it is auto-packaged again. The award level can increase or decrease without any adjustments to the existing or non-existing disbursements. This functionality ensures that the fund source and all funds counted against the COA are compliant.