Background for NSLDS and Overlapping Loans

The National Student Loan Data System (NSLDS) maintains a history of Title IV aid awarded to students nationally. This data is shared with the Central Processing System (CPS), which then populates the student awards in the NSLDS section of the Institutional Student Information Record (ISIR). The information is used to ensure that the regulations related to overlapping loans and Title IV grants paid at a prior institution can be captured in Anthology Student and considered when awarding Title IV aid.

If a student enrolls in a program version that is configured to use academic calendars that use clock hours or credit hours without terms after having taken out a loan at another school with an academic year that overlaps the academic year at the second school, the new school can originate a loan for the remaining portion of the program or academic year if the period of enrollment for the loan at the first school overlaps the period of enrollment at the new school. The loan at the new school may not exceed the remaining balance of the student’s loan limit at the new school after the disbursements at the first school are considered. The new school may originate a loan for the remaining portion of the program or academic year regardless of whether the new school accepts transfer credits or hours from the prior school.

The feature:

-

Is available for program versions that are configured to use academic calendars that use clock hours or credit hours without terms

-

Must be configured for the campus (see COD & Packaging Settings for Campuses)

If overlapping loans are not configured, Anthology Student does not consider the overlapping loan period, and loan periods are created without the overlapping loan period. Loan periods and loan payment periods are created only if the program version is configured to use payment periods.

This configuration option also controls the packaging logic. If this option is selected, Anthology Student considers the loan amounts received in the overlapping loan period during packaging for the first loan period (regardless of whether the first loan period is an overlapping loan period). If the configuration option is not selected, Anthology Student ignores any amount received in the overlapping loan period during packaging.

Anthology Student can award students when they have overlapping loans by automatically creating the appropriate loan periods and loan payment periods. For a Direct loan, this includes:

-

Direct Subsidized loans (DIRSUB)

-

Direct Unsubsidized loans (DIRUNSUB)

To be eligible to be packaged for the overlapping loan period (stub loan period), the student must meet the following criteria.

-

An overlapping loan period exists for the current enrollment. Anthology Student uses the NSLDS data from the student ISIR to determine whether an overlapping loan period exists. This can be confirmed on the NSLDS page.

-

The number of credits or hours and the number of instructional weeks for the overlapping loan period must be specified on the NSLDS page.

Financial aid packaging functionality recognizes overlapping periods for awarding. Direct loan eligibility in the first loan period (overlapping loan period) is determined by subtracting the amount received in the prior loan period from the student's maximum eligibility in the current loan period. This logic applies to all packaging methods (manual packaging, auto packaging, and batch packaging).

In compliance with the regulations specified in the student FSA handbook, Anthology Student packages overlapping Direct loans regardless of whether the student has transfer credits or hours from the prior loan period. Also, Anthology Student does not use completed credits/hours and weeks as criteria when approving Direct loan disbursements associated with the overlapping loan period.

For schools that want to use this overlapping loan feature, it is highly recommended that best practices be in place to ensure that student NSLDS data and approved transfer credits or hours are entered before creating loan periods for the student. This ensures that the student loan periods are created correctly. If transfer credits or hours or NSLDS data are entered after the loan periods have been created, the loan periods may have to be rebuilt and the student needs to be repackaged accordingly.

Overlapping Loan Example

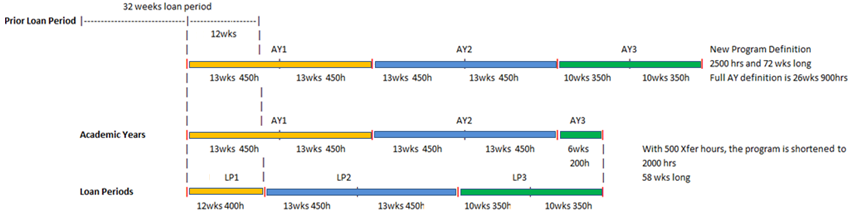

The diagram below illustrates the academic years and loan periods in Anthology Student for a clock hour student who has an overlapping loan period.

The student enrolled at school A and received a Direct loan with a loan period of 32 weeks. The student withdrew from school A before the loan period was over and refund calculation was carried out at school A. The student then enrolled at school B before the loan period at school A was over. The new program at school B consists of 2500 hours and 72 weeks. The full academic year definition at school B is 900 hours and 26 weeks. School B also accepts 500 transfer hours from school A. All 500 transfer hours are from transfer courses that were completed within the prior loan period at school A.

As a result of the transfer hours, the student’s last academic year in the program at school B is reduced by 500 hours. The program is reduced to 2000 hours and 58 weeks. This student is eligible to be packaged for overlapping loans. The first loan period is the overlapping loan period in which school B would certify a loan for the remaining balance of the annual loan limit for the period that covers the remaining portion of the loan period at school A. Loan periods for the student will be created as follows:

-

The first loan period is the overlapping period (stub loan period). The required clock hours and weeks in this first loan period are the values entered through the NSLDS page. For this scenario, based on the transferred credits and the date range of the overlapping loan period, the loan officer entered 400 hours and 12 weeks the student is expected to complete for the stub loan period. The BBAY dates on the stub loan period will reflect the original loan period at school A and are displayed within the NSLDS information. If the loan period at the prior institution is less than 30 weeks, the BBAY start date will be calculated to ensure the loan period is at least 30 weeks.

-

Subsequent loan periods are created based on the remaining hours and the full academic year definition of the program.

Based on the overlapping loan period information and transferred credits/hours from the prior loan period, Anthology Student calculates and recommends default values for credits/hours and weeks for the overlapping loan period as follows:

-

If the student has approved transfer credits from the prior loan period, Anthology Student subtracts transfer credits from the full academic year definition of the program to obtain the credits/hours for the stub loan period. The number of weeks is calculated based on the date range of the overlapping loan period.

-

If the student has no approved transfer credits from the prior loan period, Anthology Student prorates by first using the date range of the overlapping period to determine the number of weeks (normal rounding) in the stub loan period. Next, Anthology Student uses the number of weeks in the stub loan period and the full academic year definition to prorate the credits/hours for the stub loan period (rounding to 2 decimal places).

Transfer credits/hours are only used as a reference to calculate the recommended hours or credits for the stub loan period. These recommended values are displayed on the NSLDS page. The appropriate credits or hours and weeks for the stub loan period must be entered by the loan officer based on the school’s business model.

Packaging Overlapping Loans

Financial aid packaging continues to be based on academic years. For auto-packaging and batch packaging using auto-packaging, Anthology Student correctly packages Direct loans for each loan period within the academic year to satisfy the need in that academic year.

The budget for each loan period is prorated based on the budget of the academic years that encompass the loan period. Each charge will be calculated separately (such as tuition, books, and supplies). Prorating is based on:

-

Weeks if the program version is configured to prorate costs using weeks

-

Credits or hours if the program version is configured to prorate costs using credits or hours

Below is a sample calculation using the previous overlapping loan example. The tuition for academic year:

- 1 is $10,000

- 2 is $12,000

- 3 is $5,000

All 12 weeks of loan period 1 are within academic year 1. Therefore, tuition for loan period 1 is calculated as follows:

($10,000/26 weeks) * 12 weeks = $4,615

14 weeks of loan period 2 overlap academic year 1 and 12 weeks of loan period 2 overlap academic year 2. Therefore, tuition for loan period 2 is calculated as follows. Tuition for:

-

Academic year 1 = ($10,000/26 weeks) * 14 weeks = $5,385

-

Academic year 2 = ($12,000/26 weeks) * 12 weeks = $5,538

-

Loan period 2 = $5,385 + $5,538 = $10,923

14 weeks of loan period 3 overlap academic year 2 and 6 weeks of loan period 3 overlap academic year 3. Therefore, tuition for LP3 is calculated as follows. Tuition for:

-

Academic year 2 = ($12,000/26 weeks) * 14 weeks = $6,462

-

Academic year 3 = ($5,000/6 weeks) * 6 weeks = $5,000

-

Loan period 2 = $6,462 + $5,000 = $10,538

This example illustrates prorating based on weeks. The same logic applies when the program version is configured to prorate costs using credits/hours. The calculated amounts are rounded. Based on this example, we recommend calculating the budget for all academic years in advance before loan periods are created. This will ensure more accurate budget information for the loan periods. The loan period budget can also be recalculated through the loan period form if budgets in the academic years are changed.

-

Packaged EFC/SAI of a loan period comes from the ISIR being paid on for the academic year.

-

Estimated Financial Assistance (EFA) of a loan period is calculated by prorating the awards in the academic year that overlaps the loan period. Prorating is based on the number of weeks. Prorating is done at the academic year’s payment period level. For example, there is a Pell award for $4000 in AY 1. There are two payment periods with $2000 in each payment period. This Pell award is counted as EFA for both LP1 and LP2.

EFA from Pell for loan period 1:

($2000 in the first payment period / 13 weeks) * 12 weeks = $1,846

EFA from Pell for loan period 2 will be calculated based on awards that are in both academic years 1 and 2:

-

($2000 in the first payment period / 13 weeks) * 1 week = $154

-

All $2000 in the second payment period will be considered because all of the second payment period overlaps with loan period 2

-

If other awards exist in academic year 2, they will be prorated and included in the EFA of loan period 2.

EFA for loan period 3 will be calculated based on awards in academic years 2 and 3.

Based on this example, it is recommended that when packaging for overlapping loans, non-Direct loan awards be packaged in advance if possible, before packaging for Direct loans. This way EFA can be correctly calculated for loan periods that cross over multiple Academic Years. This will allow the student to be packaged accurately.

For the first loan period, the Direct loan amount to be awarded is determined by subtracting the amount already received at the prior institution from the student’s maximum eligibility at the current institution. Other loan periods will be packaged up to the maximum amount based on the student’s grade level and dependency status in the loan period.

Anthology Student validates the final loan amount so that it cannot be greater than the COAs of the loan period.

Overview of Steps for the FA Administrator

To configure overlapping loans, perform the following steps:

-

Check the campus configuration. Settings > System > Campuses > <select campus> Financial Aid must have the option to use overlapping loan periods selected for all campuses.

-

All academic years after AY 1 must be deleted.

-

Edit AY 1 and leave the AY start date as it is.

-

Change the end date to match the AY end date of the prior school.

-

In the Loan period folder, delete all loan periods that are not loan period 1.

-

Enter Loan period 1 and abbreviate the loan period from the start date of the student to the end date of the AY.

-

Change the AY to match the exact start and end dates of the prior institution.

-

Make the appropriate changes to the Payment Periods (PPD 1 and 2 dates, hours, weeks) and save.

-

Award the loan in an approved status. It should populate the proper AY dates and loan period.

-

Subsequent academic years must be added manually and populated manually in the same manner.