Edit Direct Loans

You can use the Awards tab on the Awarding page to edit a Direct loan for a student. This includes:

-

Direct Subsidized loans (DIRSUB)

-

Direct Unsubsidized loans (DIRUNSUB)

-

Direct PLUS loans (DIRPLUS)

The grid shows the items for the program version for the current enrollment (if any). Use the Program Version drop-down to change the program version. You cannot select All Program Versions.

Note: When you edit awards, you may have to change the award amounts on the NSLDS Information form to $0.00 or delete records on the Current Data tab of the NSLDS form. See Edit and Review NSLDS Information.

Prerequisites

You must have:

-

Common - Student - View authorization

-

Financial Aid - Student Award - Edit authorization

If your institution has configured permissions for fund sources, you must also be in a staff group that has permission to edit the fund source.

To set the status of the award to Approved, you must also be in a staff group that has permission to approve the fund source. If you do not have permission, the award is saved with a status of Estimated.

The student must not be in a financial aid hold group.

If the fund source for the award is configured to be Title IV and your institution has configured the campus to require:

-

An ISIR on file to add a Title IV award, the student must have an ISIR on file

-

A verified ISIR to save a Title IV award with a status of Approved, the student must have a verified ISIR on file at your institution

You should also be familiar with the Background for Direct Loans.

Access Method

Awards tab (Select the Students tile > select the name in the Students list > expand Financial Aid > select the Awarding tile > Awards tab.)

Procedure to Edit the Award

Some fields related to originating the loan are disabled. For example, the:

-

Origin Ack. Date

- Grade Level field for the loan

-

Borrower US Citizen field (Borrower Information tab)

You cannot edit those fields.

If you need to reallocate Direct loan amounts, for example, reduce a DIRUNSUB and increase the DIRSUB for a student, you need to refund the DIRUNSUB amount, increase the DIRSUB amount, and send the origination change to COD. See Review Origination Changes.

-

Verify that the program version is correct. If not, select the specific program version in the Program Version drop-down list.

-

Under New Direct Loan, change the values.

-

If you selected a disbursement schedule or the payments were calculated, select the Scheduled Disbursements tab to review the disbursements. The fields will vary and depend on the program version.

-

Select the Borrower Information tab and change the values. The fields vary and depend on the type of Direct loan.

Note: For the student to validate when exporting federal loans to COD, the student's profile must have a valid address in the U.S.

Parent Unable to Obtain PLUS Loan

Note: If you use the Automated COD Import process, see Add or Edit COD Jobs for additional information.

-

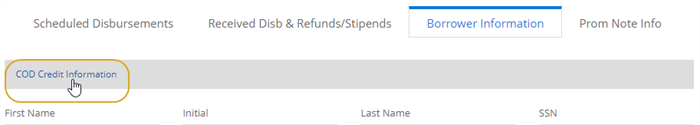

If the loan is configured to be a DIRPLUS loan, select the COD Credit Information link on the Borrower Information tab.

Review the COD credit information for the borrower.

Origination Credit Decision Status

The Financial Aid Automation process will not validate MPN Information for Parent PLUS and Grad PLUS loans when the Endorser is Approved and the MPN is expired. This validation is applicable only for that loan and not any other Direct PLUS Loans taken in the same award year or academic year. However, ELIGBLTY0086 and CODEXPRT0053 exceptions will continue to be created when the MPN is expired for Parent PLUS and Grad PLUS loans and there is no Endorser Approval.

-

Select the Prom Note Info tab and change the values.

Date Signed Prom Note Received

Prom Note Accepted Amount Date

-

If the loan is configured to be a DIRPLUS loan, change any needed values under Borrower Employment Information.

-

If the loan is configured to be a DIRPLUS loan, select Reference Address 1 and Reference Address 2 on the toolbar and change the values.

-

In the dialog, select the Save button.

-

If you need to add notes, select the Note tab.

-

If you want to save and:

-

Continue making changes, select the Save button

-

Close, select the Save & Close button

Anthology Student performs the same validations it did when you added the Direct loan. Anthology Student validates:

-

The amount so that it does not exceed the maximum allowed for the award or maximums configured by your institution (such as limiting awards to the student cost of attendance)

-

Any authorization limits configured for the general ledger

Anthology Student compares the packaged amount with the loan limit set up for the fund source. If the amount is greater than the loan limit, Anthology Student uses the loan limit.

If your institution has configured an automatic promotion process or document triggers, they are initiated after you save the award.

Select the  icon to prevent processes like Student Pace Evaluation (SPE) and Student Financial Aid Automated Awarding (SFAAA) from automatically adjusting the start and end dates when an event occurs that affects the credits or hours a student needs to complete a program.

icon to prevent processes like Student Pace Evaluation (SPE) and Student Financial Aid Automated Awarding (SFAAA) from automatically adjusting the start and end dates when an event occurs that affects the credits or hours a student needs to complete a program.

For more details, see

Limitations

You cannot edit the values for a Direct loan if it has a status of Approved and your campus prevents you from modifying Title IV aid.

You cannot edit an award if the fund source for the award has been disabled.